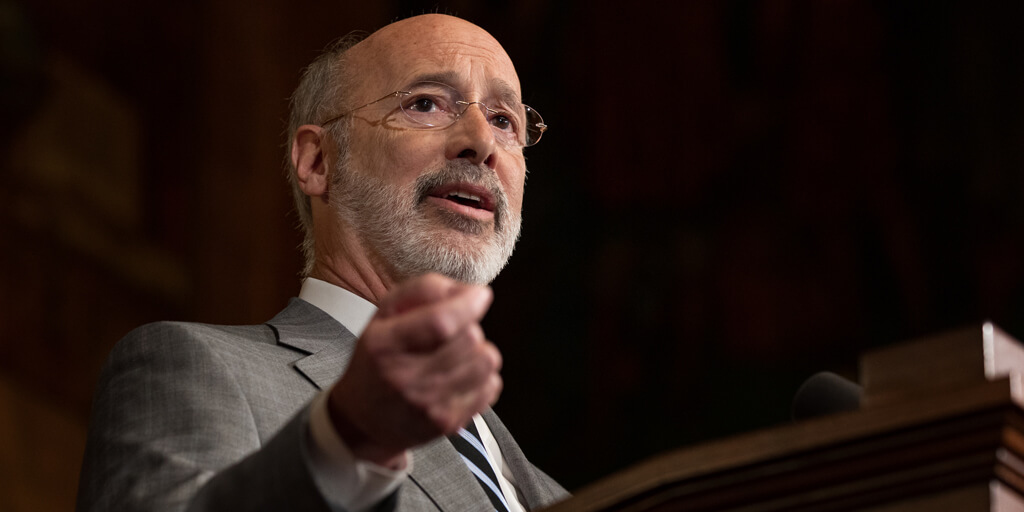

Governor Tom Wolf today requested that the U.S. Small Business Administration (SBA) implement an SBA disaster declaration to provide assistance in the form of SBA Economic Injury Disaster Loans for businesses and eligible non-profits in all 67 counties in Pennsylvania.

Governor Tom Wolf today requested that the U.S. Small Business Administration (SBA) implement an SBA disaster declaration to provide assistance in the form of SBA Economic Injury Disaster Loans for businesses and eligible non-profits in all 67 counties in Pennsylvania.

“The impact of financial losses related to COVID-19 will be felt for years to come,” said Gov. Wolf. “But these low-interest loans can help bridge the gap between economic losses now and economic recovery in the future.”

SBA’s Economic Injury Disaster Loans offer up to $2 million in assistance and can provide vital

economic support to small businesses to help overcome the temporary loss of revenue they are

experiencing. These loans may be used to pay fixed debts, payroll, accounts payable and other bills that can’t be paid because of the disaster’s impact.

The interest rate is 3.75% for small businesses without credit available elsewhere; businesses with credit available elsewhere are not eligible. The interest rate for non-profits is 2.75%.

SBA offers loans with long-term repayments in order to keep payments affordable, up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower’s ability to repay.

The application process will be facilitated online. Details on how to apply, as well as deadlines, will be established once the governor’s request is granted.

In addition to making sure that this federal funding for small business assistance is available, the Wolf Administration is working with the General Assembly to make sure state funding is available for small business assistance too. Small businesses can apply through the Small Business First Fund (SBD), an existing PIDA loan program.

More information is available at www.dced.pa.gov.